Precedent for Unprecedented Times

With the recent swings in the market, we wanted to provide a new update on what we are seeing in the market and the economy. This week has seen some strong returns, particularly on Tuesday, when the S&P 500 index posted its eighth-highest daily return in history at 9.38%. Individuals may be feeling like a day as strong as this is proof that the worst of this crisis is behind us, and we would love that to be true. However, we would like to provide some historical context and precedent in these unprecedented times.

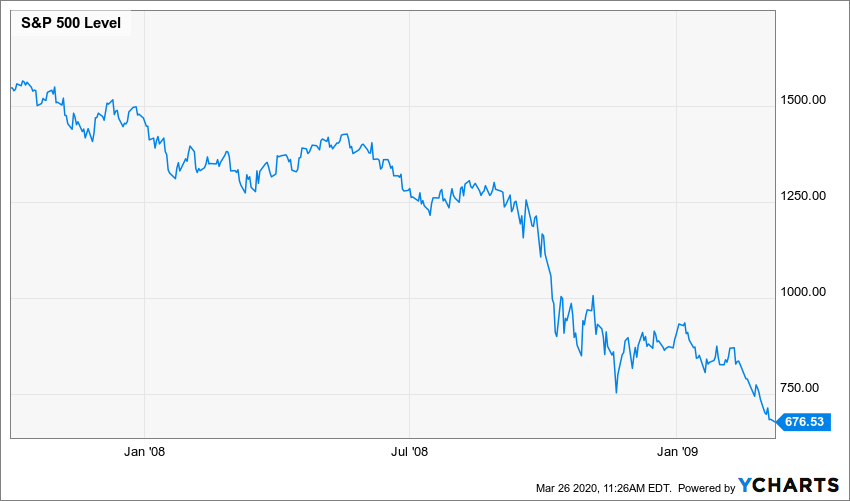

As was previously mentioned, there have only been seven days in the S&P’s history in which the market posted a greater daily return than the one we saw on Tuesday. In order from largest to smallest, these other seven days happened in 1933, 1929, 1931, 1932, twice in October 2008, and 1939. Anyone familiar with history will recognize that, yes, the largest up days in market history happened during the Great Depression and Great Recession, which can seem counterintuitive. The two modern-day examples in October 2008 are an interesting case study. On October 13, 2008, the S&P 500 posted a return of 11.58%. If you were an investor who started to feel FOMO (Fear of Missing Out) about potentially missing the beginning of the next bull market and entered the market after this day, you would have experienced a decline of over -32% after this day. In fact, as soon after as October 22, 2008, the market was setting a new low. On October 28, 2008, the S&P 500 had a return of 10.79%. Now, if you refused to act on the first large up day but saw this day as confirmation, you would have experienced a decline of roughly -28% before the market bottomed out on March 9, 2009. While this isn’t to guarantee that we will see this sharp of a decline after Tuesday’s strong day, it does tell us that these days are far from a signal that we are out of the woods.

Also, another aspect of recessionary drawdowns is continual fluctuations off the bottom before setting new lows. We decided to look at the past two recessions, as well as the crash of 1987 to see if there is a precedent for these kinds of upswings during bear markets. In 2008, the S&P 500 had five separate instances where the index was 10% or more off the bottom before pulling back and setting a new low. In fact, on January 6, 2009, the S&P 500 was over 24% off the bottom before losing these gains in the following two months. In 2000, the S&P 500 once again had five separate occasions where the index was over 10% off the bottom before setting new lows shortly thereafter.

On January 4, 2002, the market was over 21% off the bottom before pulling back -33.75% afterwards. Lastly, even a crash as fast as Black Monday saw the market over 10% off the bottom before pulling back and setting a new low a little over a month later. As of Wednesday’s close, the S&P 500 is now 10.64% off the bottom. While these improvements are a welcomed sight, history has shown us that the market simply having upturns during bear markets is not unprecedented and typically isn’t an end-all signal that it is time to enter the market again.

Now that we have discussed precedent for these situations, let’s discuss some of the unprecedented events happening today. Today it was announced that unemployment claims last week were 3.28 million, which not only is nearly five times the previous record high from 1982, but it is also much higher than the consensus estimates of 1.5 million by economists surveyed by Dow Jones. Also, recent estimates by some of the largest banks are projecting U.S. GDP (a measure of the amount of goods and services produced in the U.S.) to decline anywhere from -14% to -30% in the second quarter of this year, in no small part due to the social distancing and quarantines we have seen. While these levels are unprecedented, the hope would be that this kind of a contraction will be short-lived. However, with many service industry employees (particularly in restaurants and entertainment) being laid off, it is difficult to exactly project how this recovery will take shape.

While we are experiencing both unprecedented and precedented times during this crisis, one crucial aspect regarding investing is to stay the course. More than half of our recession indicators continue to maintain a negative reading, which means that we suggest remaining on the sidelines for now. When we begin to see strength return to these indicators, we will begin our reintroduction into the market. However, we have yet to see any material improvement in any of the indicators, even after Tuesday’s upswing. In fact, none of the indicators through 2000 and 2008 fell for any of the false 10% upswings; the indicators only began gaining real strength when the recessions were truly finished. Remember, a math-based process can remove the two most dangerous emotions for an investor: fear and greed. In the past, we have cautioned against reacting fearfully during corrections, but we also want to caution against reacting with greed when it comes to entering the market again; a buy discipline is just as crucial to an investment process as a sell discipline. We will continue to monitor things daily to see if this week’s movement is another historical head fake, or if it is a sign of strength returning to the market. In the meantime, if you have any questions or concerns, don’t hesitate to reach out.

Thank you,

Bud Verfaillie and Ashley Rosser

Bud Verfallie, CEO

Bud Verfallie, CEO

Bud holds several professional designations including: AIFA (Accredited Investment Fiduciary Analyst/Center for Fiduciary Studies), PPC (Professional Plan Consultant/Financial Service Standards), and CFP (Certified Financial Planner/College of Financial Planning), ranking him in the top 1% of all Investment Consultants nationally.

Bud has been an instructor/trainer for over 25 years. Subjects include: “How to Initiate a Successful Asset Management Business in Your Accounting Firm”, “Converting Your Commissioned-Based Investment Practice to Fee-Based”, “How to Establish an Asset Management Practice”, and “Investments and Financial Planning.” Bud has taught financial planners CFP Preparatory classes for the NIF.

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

The opinions voiced on this website are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and not be invested into directly. The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.