Historic Trends in Market Volatility and Global Instability

We have all been watching the tragic events in Ukraine unfold. Our hearts and prayers are certainly with all the innocent lives being affected and praying that resolution will be found quickly and peace will be restored.

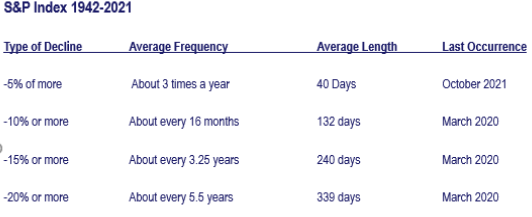

It is no surprise that we have seen the global financial markets experience increased volatility since the invasion began. If you follow Ashley’s videos you will know markets were extremely deviated from their long-term moving averages and were well overdue for a pullback as we entered 2022. Markets have been under pressure since January as they tried to grapple with rising interest rates, inflationary pressures, slowing economic growth, and disappointing earnings growth. Geopolitical instability just threw gasoline on an existing fire. I have attached a chart that shows the history of market corrections and how often investors should be prepared for 5% ,10% and even 20% corrections over time.

Historic Trends in Market Volatility and Global Instability

Markets are holding up well considering the current circumstances we are experiencing. The S&P 500 is currently trading above the October 2021 lows when we experienced a near 5% decline. We just haven’t really gone anywhere since October 4th trading sideways with bouts of high volatility. There are additional headwinds markets will need to contend with over the next few months, but the biggest concern remains the Federal Reserve’s next steps. Despite the recent correction, the markets remain convinced the Fed will hike a minimum of four times in 2022 and further in 2023. At the same time, the liquidity support from ongoing “Quantitative Easing” programs will reverse. However, if the Federal Reserve decides to be less aggressive with either considering the current level of volatility, markets will likely see at least short-term rallies. Markets are significantly oversold on nearly every level and so bounce in positive performance would not be unexpected.

Considering everything we know, what should investors do right away? In short, nothing. Notably, geopolitical events have only minor impacts on markets and tend to be short-lived. Therefore, making significant changes to portfolios based on geopolitical events has generally not worked out well for investors. I would warn if you have been feeling uneasy during the last two months it could be a sign you are invested too aggressively. You could use any upcoming rallies to reduce equity exposure and rebalance your portfolio. As mentioned above, there are still headwinds to contend with outside of the Russian Ukraine invasion and they will likely be present for the foreseeable future. You can also watch Ashley’s youtube video https://youtu.be/VJkxic3CbW0 as she discussed charts looking back at the last Ukrainian invasion in 2014 and how markets responded then. During that time, markets had been under pressure even before the invasion. The bottom of the market came the day of the invasion, and a strong rally began the very next day and lasted for months. No one can say if we will see the same this time, but history does have a habit in repeating itself. For now, our hearts and prayers are with Ukraine and the innocent lives being affected by this tragedy. If you have any questions, please do not hesitate to contact us, we are always here to help.

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.